ASUNCIÓN, Paraguay – The Financial Development Agency (AFD) of Paraguay is significantly diversifying its portfolio by prioritizing support for Small and Medium-sized Enterprises (MiPymes) and women-led ventures. AFD's loan portfolio, which was only USD 18 million in 2006, has now surpassed USD 1.18 billion, a major achievement as the AFD celebrates its 20th anniversary.

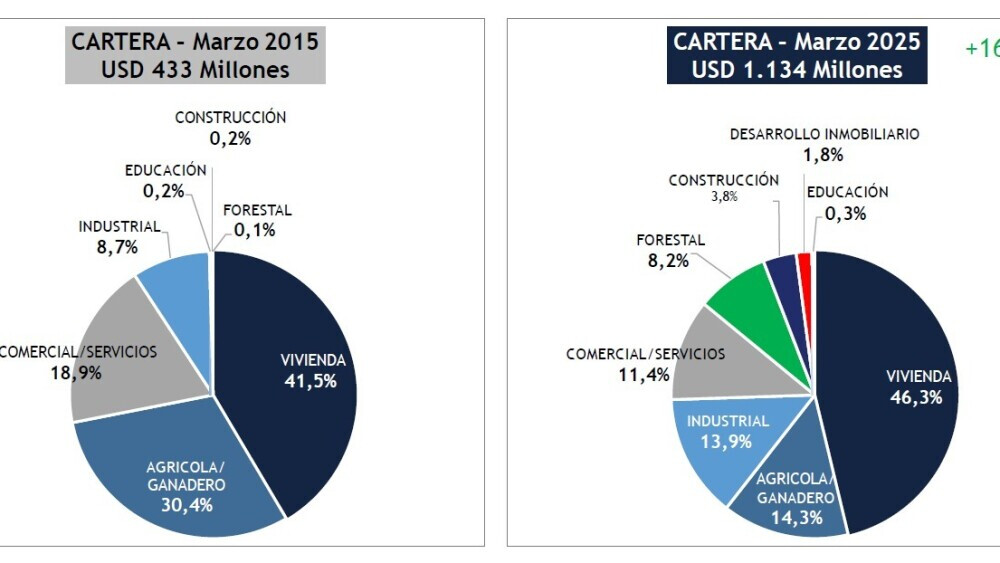

Historically focused on agriculture and livestock, the AFD is now expanding its support to include commerce, industry, and the rapidly growing green economy. Fernando Lugo, General Manager of AFD, stated that although housing loans still account for the largest share, the AFD is increasingly focusing on sectors with significant economic and social impact. This shift is evident in the fact that loans for agriculture and livestock, which constituted 30.4% of the total portfolio in 2015, have now been halved. Instead, new niche markets such as industry and forestry are emerging.

A core component of the AFD's strategy is supporting SMEs. Lugo emphasized, "SMEs are an essential pillar of our strategy, creating a significant number of formal jobs in Paraguay, revitalizing local economies, and fostering regional development." The AFD is committed to facilitating financing tailored to the needs of SMEs to promote their growth, formalization, and sustainability.

Support for women-led ventures, in particular, is another major priority for the AFD. Lugo added, "We are strengthening our support for women-led ventures because we firmly believe that empowering women transforms not only their households but also entire communities and the economy." This demonstrates AFD's firm belief in the positive impact of women's economic participation on national economic development.

Currently, 46.3% of the AFD's portfolio is allocated to housing loans, followed by agriculture and livestock (14.3%), industry (13.9%), commerce and services (11.4%), forestry (8.2%), and other sectors (5.9%). This diversified investment across various sectors reflects AFD's efforts to reduce reliance on specific industries and mitigate risks.

Lugo emphasized that over the past two decades, the AFD has transcended its role as a mere second-tier financial institution. The AFD also acts as an investment agent and a coordinator within the financial system, leading the development of emerging economic sectors. In particular, through investments in nascent fields such as forestry, energy efficiency, and the green economy, it is promoting more sustainable production models.

The AFD's diverse loan products and operational methods will be showcased to the public at the 2025 AFD Forum and Expo, to be held in August to commemorate the AFD's 20th anniversary. This event will be an important opportunity to introduce the various loan programs offered by the AFD through its strategic partners (banks, financial companies, cooperatives) and to engage with the public. The event is expected to be a chance to look back on the AFD's 20 years of contributions to Paraguay's economic development and to share its future vision. This diversification strategy of the AFD is regarded as a significant step towards sustainable growth and inclusive development of the Paraguayan economy.

[Copyright (c) Global Economic Times. All Rights Reserved.]