(C) Campaign Asia

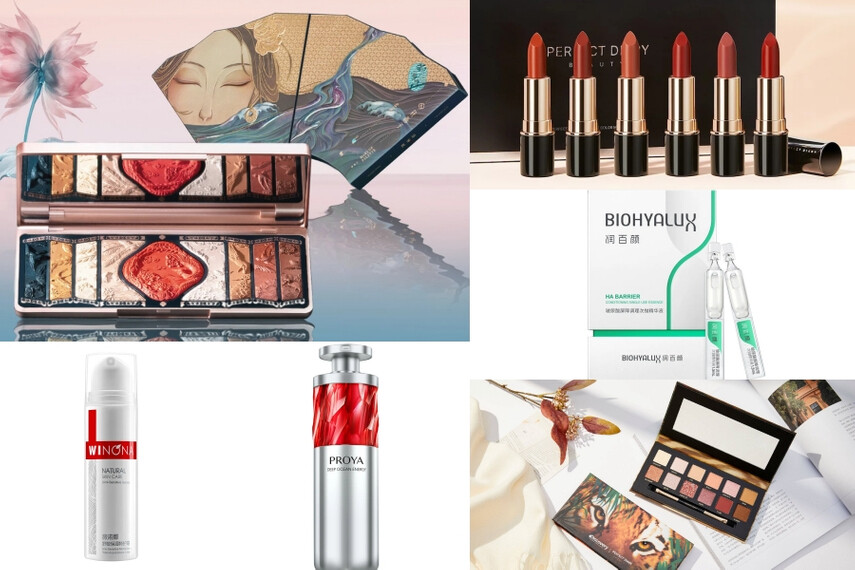

SEOUL — Chinese domestic cosmetic brands, collectively known as "C-Beauty," are aggressively expanding their global footprint, signaling a fierce competition with the long-standing industry leader, K-Beauty. Leveraging the "Guochao" (nationalistic consumption) trend and a massive domestic market, these brands are now setting their sights on international markets, including South Korea and Southeast Asia.

Shifting Gears: From Domestic Loyalty to Global Expansion

According to recent data, China’s cosmetics exports reached $3.99 billion between January and November last year, an 8.7% increase year-on-year. While South Korea still maintains a significant lead with $10.3 billion in exports, the gap is steadily narrowing. Over the past five years, China’s cosmetic exports have grown at an average annual rate of 18%.

The saturation of the Chinese market and a slowing domestic economy have pushed local giants to look outward. Brands like Flower Knows, famous for its ornate, princess-themed packaging, have recently launched pop-up stores and official online malls in Seoul, directly entering the heart of the K-Beauty market.

The Strategy: Color Cosmetics and Viral Trends

C-Beauty’s primary weapon is color cosmetics rather than high-end skincare. Industry experts note that the barrier to entry for makeup is lower, as consumers are more willing to experiment with affordable, visually striking products.

By utilizing platforms like Douyin (the Chinese version of TikTok), these brands are viralizing specific aesthetics, such as the "doll-like makeup" style. This digital-first strategy has proven highly effective in Southeast Asia, where Chinese brands have seen growth rates exceeding 100% annually over the last five years in countries like Malaysia, Singapore, and Thailand.

Challenges Ahead: The "Trust Gap" and Cultural Influence

Despite the rapid growth, C-Beauty faces a significant hurdle: the established prestige of K-Beauty’s skincare technology. "While Chinese brands are succeeding in the makeup sector, they still face limits in the premium skincare market where long-term efficacy and brand trust are paramount," noted Bloomberg Intelligence.

Furthermore, analysts emphasize that commercial success often follows cultural influence. Just as K-Beauty rode the wave of the "Korean Wave" (Hallyu), C-Beauty may require a similar cultural catalyst. "For Chinese brands to truly succeed on the global stage, they need cultural mediums like C-Dramas or popular actors to lead the way in showcasing Chinese beauty standards," suggested the Economist Intelligence Unit.

As the lines between price points blur, the future of the global beauty market will likely depend on which industry can better blend technological innovation with cultural storytelling.

[Copyright (c) Global Economic Times. All Rights Reserved.]