Seoul, South Korea – Woori Financial Group announced on December 2nd the launch of its new universal banking app, 'NEW WooriWON Banking,' which consolidates all core services from its subsidiaries.

This latest version, a complete overhaul after five years, significantly upgrades the previous WooriWON Banking app and introduces a new universal banking feature. Customers can now access various financial services from Woori Bank, Woori Card, and other subsidiaries through a single app, eliminating the need to switch between multiple applications.

The 'NEW WooriWON Banking' app offers a unified view of various financial products and services from all group companies and allows customers to use 'Honey Money,' the group's integrated point system, across all subsidiaries.

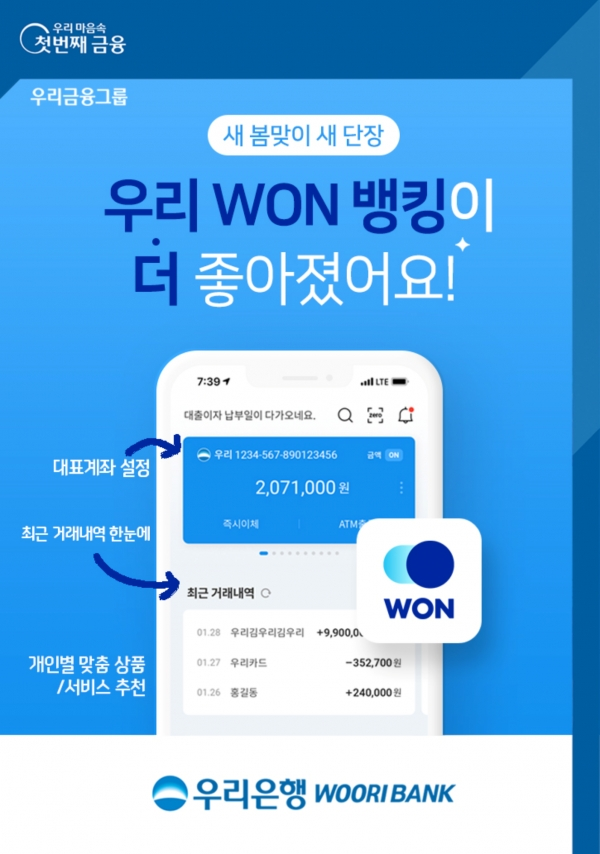

Woori Financial Group has adopted a user-centric UX design, prioritizing the principle of "providing all financial services centered around the customer." The app features several new personalized services, including:

Customizable home screen: Users can arrange the app's layout to suit their preferences.

AI-powered customer service: The app offers AI-driven chatbots for quick and convenient support.

Comprehensive asset management: Customers can view their assets from all financial institutions in one place.

The app also features enhanced AI-powered customer service and dedicated customer support, as well as interactive investment profiling and a service that allows customers to submit loan documents without visiting a branch.

"We have significantly upgraded the performance and speed of the 'NEW WooriWON Banking' app, and by reflecting customer feedback, we have improved the home screen layout, search function, customer support channels, and screen linking functions," said a Woori Financial Group official.

Woori Financial Group plans to introduce new businesses and services, such as the 'WooriWON Mobile' affordable mobile phone service and the 'Woori Investment Securities' mobile trading system (MTS), through the 'NEW WooriWON Banking' app by the first half of next year.

[Copyright (c) Global Economic Times. All Rights Reserved.]