(C) Mint

WASHINGTON, D.C. — U.S. Treasury Secretary Scott Bessent has struck a deeply optimistic tone regarding the American economic outlook for 2026, confidently dismissing the threat of a full-blown recession despite acknowledging the recent, longest-ever federal government shutdown inflicted an estimated $11 billion in "permanent damage" to the economy.

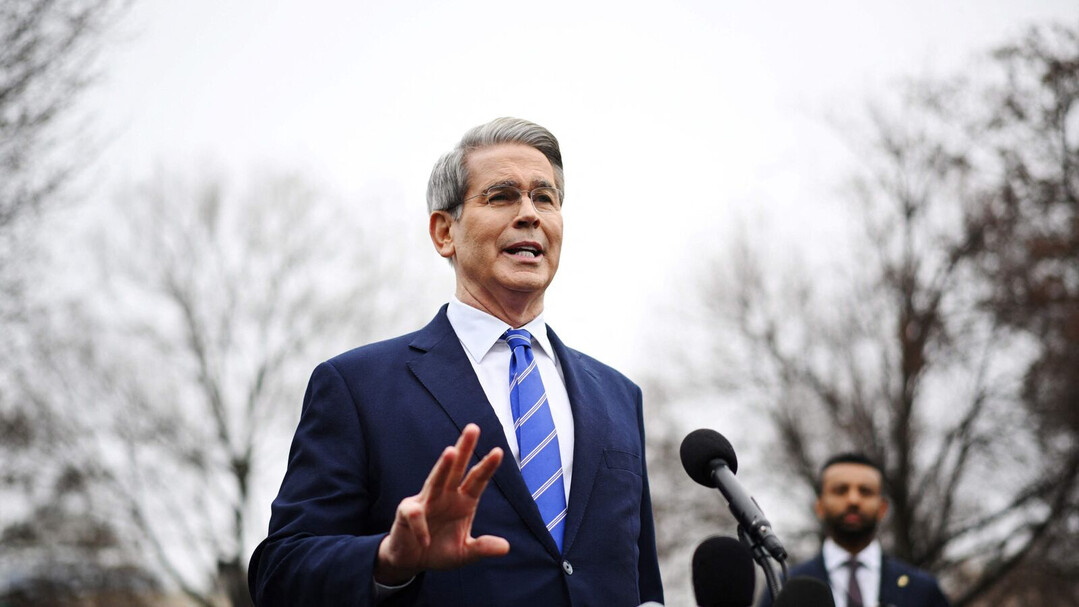

Appearing on NBC's "Meet the Press" on Sunday, Bessent presented a forward-looking perspective, arguing that a convergence of tax relief measures, easing interest rates, and new trade agreements is "setting the table for a very strong, non-inflationary growth economy" in the coming year.

The Cost of the Shutdown: A Permanent $11 Billion Hit

The recent, protracted government shutdown, which lasted over 40 days, delivered a significant blow to the national economy. Bessent confirmed the financial cost, stating the shutdown resulted in an $11 billion in permanent economic loss. This figure aligns with estimates from nonpartisan bodies like the Congressional Budget Office (CBO), which had previously warned of permanent losses in the range of $7 billion to $14 billion due to factors like reduced output from furloughed federal employees and disrupted government services.

The economic hit was concentrated in the final quarter of the year, temporarily reducing the annualized GDP growth rate by as much as 1.5 percentage points, according to some analyses. Bessent emphasized that while interest rate-sensitive sectors, most notably housing, have been struggling and are experiencing a de facto recession, the overall U.S. economy is not at risk of negative growth.

Optimism for 2026: Tax Cuts and Real Income Growth

The Treasury Secretary's strong confidence for 2026 is largely predicated on the anticipated impact of recent legislative changes, which he framed as a massive boost to the purchasing power of working Americans.

Bessent pointed to the "One Big, Beautiful Bill," which includes several targeted tax reductions designed to increase workers' real disposable income:

No Tax on Overtime: Capping the tax on overtime pay.

Tax Cut on Tips: Eliminating taxes on tip income.

Social Security Tax Relief: Granting a social security tax reduction for certain low-to-middle income individuals.

Auto Loan Deductibility: Allowing deductions for loans taken out for American-made automobiles.

These measures, he argued, will lead to "substantial refunds to working families in the first quarter of 2026," as many Americans have yet to adjust their payroll withholding despite the new tax laws taking effect. Bessent believes this infusion of cash will fuel consumer spending and act as a powerful engine for economic growth.

Inflation Outlook: Blame on Services, Not Tariffs

Addressing the persistent issue of inflation, which is currently running at about 3% annually, Bessent notably deflected the blame away from the administration's broad trade tariffs—a staple of the Trump economic policy.

Instead, the Secretary attributed the ongoing price pressures to the services economy and a "perfect storm" of other factors, rather than the import duties. He expressed a strong expectation that the inflation curve is set to bend downwards, citing recent positive signs:

Falling Energy Prices: A key deflationary trend observed in October.

Trade Deals: Bessent announced the signing of new trade agreements, particularly with Central and South American countries, which he suggested would lead to a reduction in tariffs on key imports like bananas and coffee, consequently lowering consumer prices.

While Bessent’s confidence remains high, the administration is also considering a new plan to distribute tariff revenues directly to low- and middle-income Americans through a potential $2,000 "tariff dividend." However, Bessent has urged Americans who may receive the payment to save it rather than spend it immediately, in an effort to mitigate any potential inflationary impact from the stimulus.

Trade and Manufacturing: New Plant Openings Expected

Adding to his optimistic forecast, Bessent predicted that the administration's trade and economic policies would encourage a resurgence in domestic manufacturing. He specifically pointed to the expectation of new plant openings across the country, suggesting that trade agreements and domestic incentives are successfully driving companies to invest in American production.

"I am very, very optimistic about 2026," Bessent concluded, echoing a sentiment of "parallel prosperity" where both Wall Street and Main Street can thrive. He believes the groundwork is laid for an era of accelerated economic growth, with the negative effects of the recent shutdown firmly in the rearview mirror.

[Copyright (c) Global Economic Times. All Rights Reserved.]