Plato Gold Corp. (TSX-V: PGC; OTCQB: NIOVF; FSE: 4Y7; WKN: A0M2QX), an exploration company with a portfolio of mineral properties in Northern Ontario and Santa Cruz, Argentina, has announced that preparations for its maiden drilling program at the gold-silver Lolita Project in Santa Cruz, Argentina, are progressing well.

Representatives from Plato and its Argentine subsidiary, Winnipeg Minerals S.A., held meetings with officials from the Santa Cruz provincial government in early March at the Prospectors and Developers Conference (PDAC) in Toronto.

The Santa Cruz Mining Secretariat is actively encouraging new exploration projects to revitalize the existing production pipeline. Plato previously submitted studies and documentation related to an updated Environmental Impact Assessment report, which the Santa Cruz Mining Secretariat approved in late March 2025. This approval grants Plato the authorization to conduct its diamond drilling campaign. Santa Cruz is Argentina's largest precious metal producer, with exports totaling US$1.789 billion in 2024.

In parallel, Plato commenced negotiations with drilling, camp, and geological contractors to carry out the planned work. Contractor selection has been finalized, and formal contract execution is currently underway.

Regarding funding for the drilling program, Plato has entered into an unsecured loan agreement for a total of $1.05 million. The loan bears an interest rate of 7% per annum and is repayable one year from the date of issue (the maturity date) unless repaid earlier at Plato's option.

At the lender's option, the loan principal may be converted into common shares of Plato at a price per share equal to the closing trading price of Plato's common shares on the trading day immediately preceding the maturity date or any earlier repayment date selected by Plato, with a minimum conversion price of $0.05 per share.

The loan proceeds are expected to be advanced to the company upon completion of the TSX Venture Exchange's approval of the loan transaction. Any securities issued or issuable pursuant to the loan transaction will be subject to a statutory hold period of four months and one day.

Anthony Cohen, President and Director of Plato, entered into an agreement to lend $1.0 million to Plato, which constitutes a "related party transaction." The company is relying on exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 1 on the basis that the fair market value of 2 the loan does not exceed $2.5 million.

Plato anticipates commencing drilling in the Southern Hemisphere fall (May 2025) and completing the drilling before the onset of the Southern Hemisphere winter. Plato plans to drill approximately 10 diamond drill holes, ranging from 200 to 400 meters in length, on the Panza, Espalda, and Corazon targets. These targets represent the upper expressions of a high-level epithermal vein system exhibiting strong geochemical anomalies of arsenic, antimony, and mercury, with the objective of exploring for precious metal mineralization at depth.

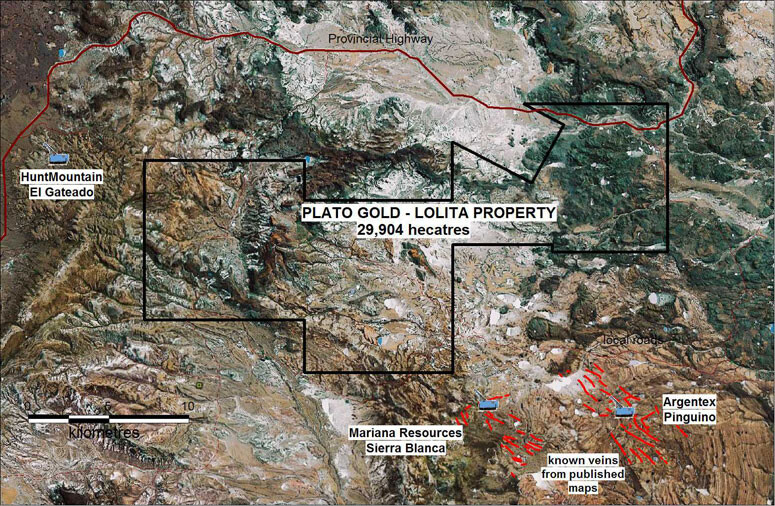

The Lolita Project is a greenfields area with no previous drilling or even precious metal exploration prior to Plato Gold's work. However, the Lolita Project is contiguous with Unicorn Silver Limited's Pingüino Project, which hosts a significant precious and base metal resource, and new drilling results by Unicorn on its Sierra Blanca area suggest the potential for developing gold-silver resources. Unicorn Silver has reported a 92 million ounce silver equivalent resource at its Cerro Leon Project (integration of Pingüino and adjacent mineral assets).

In Argentina, Plato holds a 95% interest in Winnipeg Minerals S.A., an Argentinean legal entity that controls a contiguous group of mineral rights totaling 9,672 hectares with gold and silver potential.

Plato Gold's preparations for the maiden drilling at the Lolita Project are generating significant interest in the potential for new discoveries in Argentina's promising gold-silver exploration district. The success of the adjacent Pingüino Project and the Santa Cruz province's supportive mining policies are expected to positively influence Plato Gold's exploration endeavors.

[Copyright (c) Global Economic Times. All Rights Reserved.]