Singapore-based digital bank MariBank Singapore Private Limited (hereinafter ‘MariBank’) announced on April 24, 2025, the official acquisition of SeaBank Philippines, Inc. (hereinafter ‘SeaBank Philippines’), incorporating it into its banking group. This acquisition was finalized through MariBank's acquisition of shares in SeaBank Philippines and is expected to further strengthen MariBank's position in the Southeast Asian digital finance market.

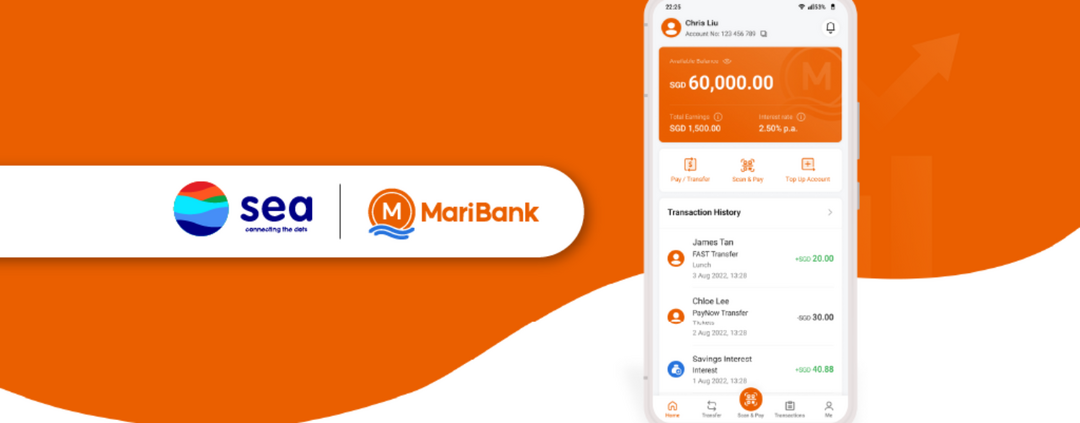

MariBank operates under a license from the Monetary Authority of Singapore (MAS) and is a wholly-owned subsidiary of Sea Limited, a major Southeast Asian e-commerce and gaming company. SeaBank Philippines was also part of the Sea Limited Group, but through this acquisition, it will be under the systematic management and supervision of MariBank, a Singapore-based banking group, which will oversee regional strategy establishment, innovation promotion, and sound governance construction.

This acquisition of SeaBank Philippines is expected to bring significant synergy to both companies. Through MariBank's investment, SeaBank Philippines is expected to secure new capital and deepen its expertise in a wide range of financial products. In particular, MariBank plans to leverage Singapore's strategic advantages as a financial services hub to identify and pursue new business opportunities for SeaBank Philippines. This is expected to greatly contribute to SeaBank Philippines providing more innovative financial services and strengthening its competitiveness within the Philippine market.

Existing customers of SeaBank Philippines will be able to continue using the same banking services for the time being. According to the announcement, there will be no changes to the services currently provided to customers. This is interpreted as MariBank's consideration to minimize customer inconvenience and maintain a stable service environment during the acquisition process. SeaBank Philippines is expected to provide customers with sufficient prior notice of any future service changes.

This acquisition of SeaBank Philippines by MariBank signifies a strategic reorganization of the financial sector within the Sea Limited Group and is seen as a move to build a stronger presence in the Southeast Asian digital finance market by combining the strengths of both companies. In particular, it reveals MariBank's ambitious plan to actively target the rapidly growing Philippine digital finance market and to expand its business to neighboring countries by leveraging Singapore's role as a financial hub.

The Philippines is evaluated as a market with very high growth potential for digital financial services based on its high population density, young demographic structure, and rapidly increasing smartphone penetration rate. SeaBank Philippines has been rapidly growing by providing various financial services such as deposits and loans based on its digital platform within this market environment. MariBank's abundant capital and technology, as well as its experience with Singapore's advanced financial system, are expected to serve as an important stepping stone for SeaBank Philippines to develop more innovative products and services and expand its customer base in the Philippine market.

Furthermore, this acquisition is expected to bring significant changes to the competitive landscape of the Southeast Asian digital finance market. Given that various fintech companies and traditional banks are already accelerating their digital transformation, the combination of MariBank and SeaBank Philippines could emerge as a stronger competitor. In particular, the synergy effect with Shopee, Sea Limited's powerful e-commerce platform, could be a significant competitive advantage by conveniently providing various financial services such as payments and loans to Shopee users.

Industry experts analyze that this acquisition of SeaBank Philippines by MariBank goes beyond simple business expansion and could serve as an opportunity to promote innovation across the entire Southeast Asian digital finance ecosystem. By providing digital financial services optimized for the Philippine market based on Singapore's financial regulatory know-how and technology, there is growing anticipation that it will increase financial inclusion and provide more people with convenient and secure access to finance.

In the future, MariBank is expected to focus on creating synergies in various aspects such as organizational culture, technology systems, and product development strategies through the integration process with SeaBank Philippines. It is also anticipated that they will concentrate on developing customized financial products and services that consider the characteristics of the Philippine market and on innovating the customer experience by strengthening digital channels.

In conclusion, MariBank's acquisition of SeaBank Philippines will be recorded as an important case demonstrating the dynamic changes in the Southeast Asian digital finance market. The combination of the Sea Limited Group's strong support, MariBank's expertise, and SeaBank Philippines' market competitiveness is expected to bring a new wave not only to the Philippine financial market but also to the broader Southeast Asian financial market. The innovative financial services that MariBank will showcase through SeaBank Philippines in the future are highly anticipated.

[Copyright (c) Global Economic Times. All Rights Reserved.]