The so-called "Big 3" luxury brands – Hermès, Louis Vuitton, and Chanel – have collectively achieved their highest-ever sales in South Korea last year, surpassing a total revenue of 4.5 trillion KRW (approximately 3.4 billion USD). This record-breaking performance is largely attributed to successive price increases implemented by the brands throughout the year. Both Hermès and Louis Vuitton raised their prices more than twice in 2024, while Chanel also increased the prices of its key products.

According to their respective audit reports released on the 13th, the combined revenue of the three brands in the South Korean market reached 4.5573 trillion KRW in the past year, marking a 9.76% increase from the 4.1521 trillion KRW recorded in the preceding year. While the broader luxury market has experienced a cooling down period following a surge in demand during the COVID-19 pandemic due to economic slowdown, these three powerhouses have managed to achieve unprecedented sales figures.

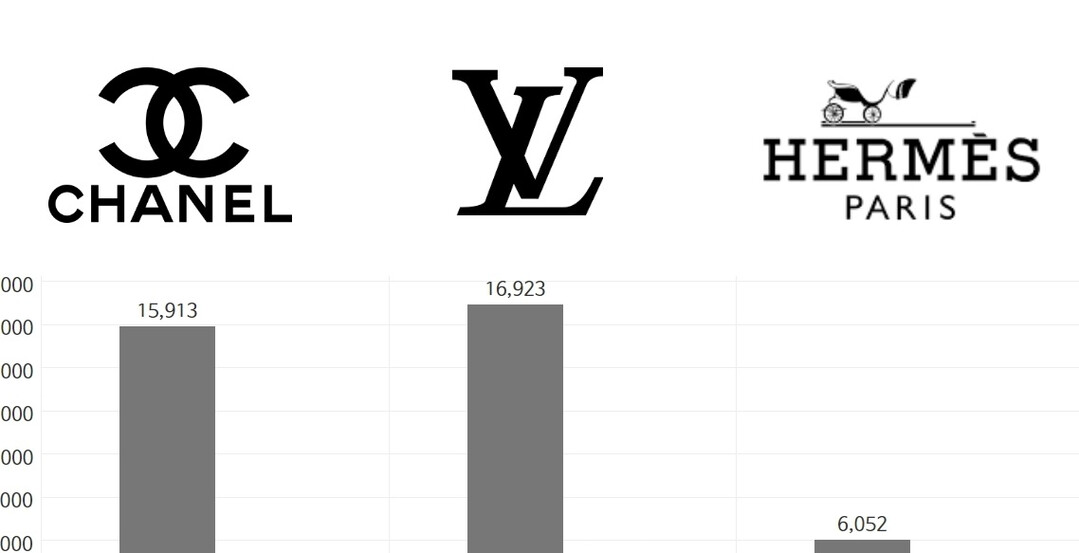

Hermès Korea reported a revenue of 964.3 billion KRW last year, demonstrating a substantial growth of 20.96% compared to the 797.2 billion KRW in the previous year. During the same period, the company's operating profit also saw a significant rise of 13.15%, increasing from 235.7 billion KRW to 266.7 billion KRW. Louis Vuitton Korea also experienced growth, with its revenue reaching 1.7484 trillion KRW last year, a 5.89% increase from the 1.6511 trillion KRW recorded a year prior. Notably, Louis Vuitton Korea's operating profit witnessed an even more significant surge of 35.72%, climbing from 286.7 billion KRW to 389.1 billion KRW. In contrast, while Chanel Korea also saw an increase in revenue, reaching 1.8446 trillion KRW last year, an 8.26% rise from the 1.7038 trillion KRW in the previous year, its operating profit slightly decreased to 269.5 billion KRW from 272.1 billion KRW.

Market Dynamics and Consumer Behavior

Industry analysts suggest that the consistent price hikes implemented by these luxury giants have played a crucial role in driving their revenue growth. Despite the economic headwinds and a general softening in consumer sentiment towards discretionary spending, the enduring allure and aspirational status of these brands appear to have allowed them to pass on price increases to consumers with relatively little impact on demand. This phenomenon highlights the unique pricing power held by top-tier luxury brands, particularly in markets like South Korea, which has a strong appetite for high-end goods.

Furthermore, the data suggests a divergence in profitability trends among the "Big 3." While Hermès and Louis Vuitton experienced significant increases in operating profit alongside their revenue growth, Chanel's operating profit saw a marginal decline despite a healthy increase in sales. This could be attributed to various factors, including differing cost structures, marketing investments, or product mix strategies employed by each brand.

South Korea's Luxury Market: A Key Battleground

South Korea has emerged as a significant and dynamic market for luxury goods globally. Its affluent consumer base, coupled with a strong emphasis on status and fashion, has made it an attractive market for high-end brands. The continued strong performance of Hermès, Louis Vuitton, and Chanel underscores the resilience and growth potential of the luxury sector in the country, even amidst broader economic uncertainties.

The strategic implementation of price increases by these brands reflects a common tactic in the luxury industry to maintain brand exclusivity and perceived value. While such strategies can bolster revenue in the short term, it remains to be seen how long consumers will absorb these increases and whether it will eventually impact demand elasticity. Nevertheless, the record-breaking sales figures for the "Big 3" in South Korea last year serve as a testament to their enduring brand power and the unique characteristics of the South Korean luxury market.

Additional Contextual Information:

South Korea's Economic Overview (2024): Briefly mention the overall economic conditions in South Korea during 2024 to provide context for consumer spending. Was it a period of strong growth, stagnation, or mild recession? This will help understand the resilience of the luxury market. (Source: Bank of Korea, Ministry of Economy and Finance reports from 2024).

Luxury Goods Import Trends: Include data on the overall import of luxury goods into South Korea in 2024 to see if the "Big 3's" performance aligns with the broader market trend or if they outperformed their competitors. (Source: Korea Customs Service data from 2024).

Consumer Confidence Index: Mention the consumer confidence index in South Korea during 2024 to gauge the general sentiment of consumers towards spending. A low index might further highlight the strength of the "Big 3" brands. (Source: Bank of Korea consumer surveys from 2024).

Competitive Landscape: Briefly touch upon the performance of other major luxury brands in South Korea (if data is available) to provide a more comprehensive picture of the market.

Reasons for Price Hikes: While the article mentions price increases, briefly speculate on the potential reasons behind these hikes, such as increased raw material costs, supply chain issues, or brand strategy to enhance exclusivity.

By incorporating these additional details, the English news article will provide a more comprehensive and insightful analysis of the record sales achieved by Hermès, Louis Vuitton, and Chanel in the South Korean market.

AI 음성 개요 생성

[Copyright (c) Global Economic Times. All Rights Reserved.]