South Korea's accommodation and food service industry is grappling with its most prolonged downturn on record as high interest rates and persistent inflation continue to fuel economic stagnation. The protracted slump has forced many self-employed individuals to lay off staff, leading to a rise in "solo" business owners and exacerbating concerns about a vicious cycle where sluggish domestic demand translates into a deteriorating employment landscape.

According to data released by Statistics Korea on April 13th, the production index for the accommodation and food service sector stood at 103.8 in February of this year, marking a 3.8% decrease compared to the same period last year. This production index is compiled based on the sales figures of accommodation and food establishments. Notably, the constant price index, which eliminates the impact of inflation, is a key indicator used to gauge real production changes and assess the overall economic trend.

The production index for the accommodation and food service sector has consistently declined year-on-year since May 2023, with the exception of January 2024, which registered no change. This unprecedented 22-month streak of non-positive growth is the longest since the statistical compilation began in 2000. Even during the height of the COVID-19 pandemic, which significantly curtailed consumption, the index saw a rebound after a 14-month decline from January 2020.

The protracted slump is hitting self-employed individuals particularly hard. In the first quarter (January-March) of this year, the number of self-employed workers totaled 5.523 million, a decrease of 14,000 compared to the same period last year. A closer look reveals a significant drop of 25,000 in the number of self-employed individuals with employees, while the number of self-employed individuals without employees increased by 11,000. This trend strongly suggests that business owners who previously hired staff are being forced to cut payrolls and operate their businesses alone due to the prolonged economic hardship.

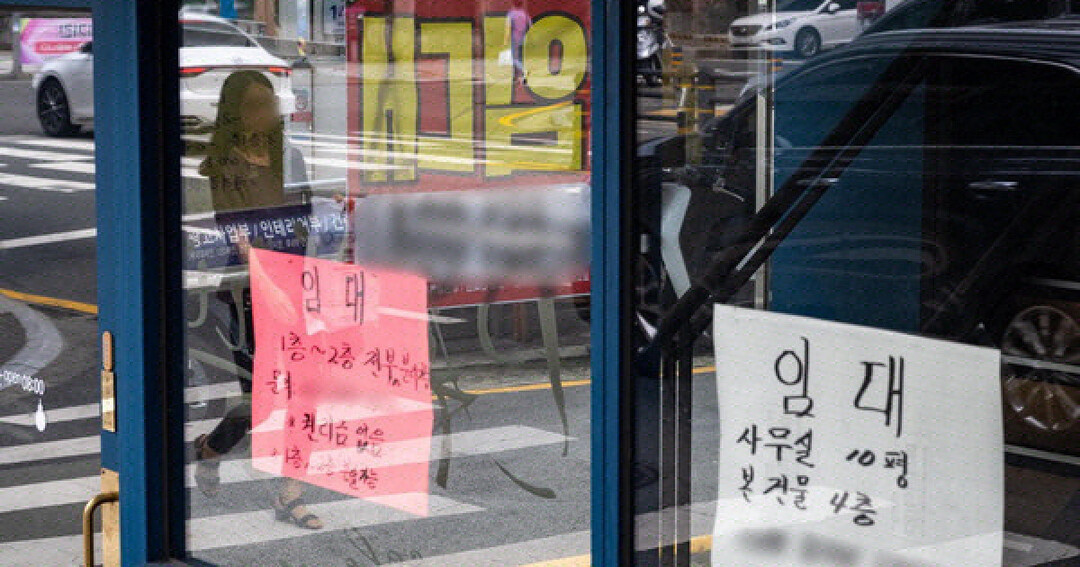

Furthermore, an increasing number of businesses are choosing to close down entirely. In 2023, the year the accommodation and food service slump began to intensify, a record high of 986,487 businesses filed for closure. Of this figure, the number of restaurant closures alone reached 158,000. Given the continued poor performance of the accommodation and food service production index, statistics for the past year, which are yet to be fully compiled, are expected to show a further increase in business closures.

In an effort to revitalize the struggling economy and alleviate the burden on its citizens, the government is planning to submit a supplementary budget of approximately 10 trillion won to the National Assembly in the near future. A significant portion of this budget, estimated to be between 3 and 4 trillion won, will be allocated to supporting low-income individuals and small business owners. An additional 3 to 4 trillion won is earmarked for addressing rapid changes in the global trade environment and enhancing the nation's artificial intelligence (AI) competitiveness.

Ha Joon-kyung, a professor of economics at Hanyang University, commented, "If the supplementary budget is passed, it will help to restore economic sentiment by signaling the government's proactive response." He further suggested, "Given the urgency, the budget should initially include items where there is no disagreement between the ruling and opposition parties, and any additional necessary measures can be addressed after the June presidential election."

Additional Contextual Information:

Consumer Sentiment: Recent surveys indicate a significant decline in consumer confidence, with households increasingly wary of spending on non-essential items like dining out and travel due to economic uncertainties and rising living costs.

Labor Market Impact: The layoffs in the accommodation and food service sector are contributing to a broader slowdown in job creation, particularly in lower-skilled service industries. This is raising concerns about rising unemployment and underemployment.

Government Support Measures (Pre-Supplementary Budget): Prior to the planned supplementary budget, the government had implemented some limited support measures for small businesses, such as temporary loan extensions and interest rate subsidies. However, these measures have been widely criticized as insufficient to address the scale of the crisis.

Long-Term Implications: The prolonged slump in the accommodation and food service sector raises concerns about the long-term viability of many small businesses and the potential for structural changes in the industry, with a possible shift towards larger chains or more streamlined operations.

Global Economic Factors: While domestic factors are primary, the South Korean economy is also facing headwinds from a slowing global economy and ongoing geopolitical uncertainties, which are impacting overall economic activity and consumer confidence.

The situation in South Korea's accommodation and food service sector underscores the significant challenges posed by the current economic climate and highlights the urgent need for effective government intervention to support struggling businesses and prevent further deterioration of the labor market. The upcoming supplementary budget will be closely watched for its ability to provide meaningful relief and stimulate economic recovery.

[Copyright (c) Global Economic Times. All Rights Reserved.]