Singapore's property market has defied expectations with a recent surge in sales, particularly for new launches. Despite online sentiment suggesting overpriced properties, projects like Katong Emerald, Nava Grove, and Novo Place have seen strong demand.

Several factors have contributed to this unexpected boom:

Pent-up demand and limited new launches in 2024:

The first half of 2024 saw a mere 1,916 units launched, the lowest since 2008 and even lower than the 1,977 units launched in the second half of 2008 during the global financial crisis.

While an additional 1,480 units were launched in the subsequent three months, bringing the total to 6,666 units, this figure still remains below historical averages.

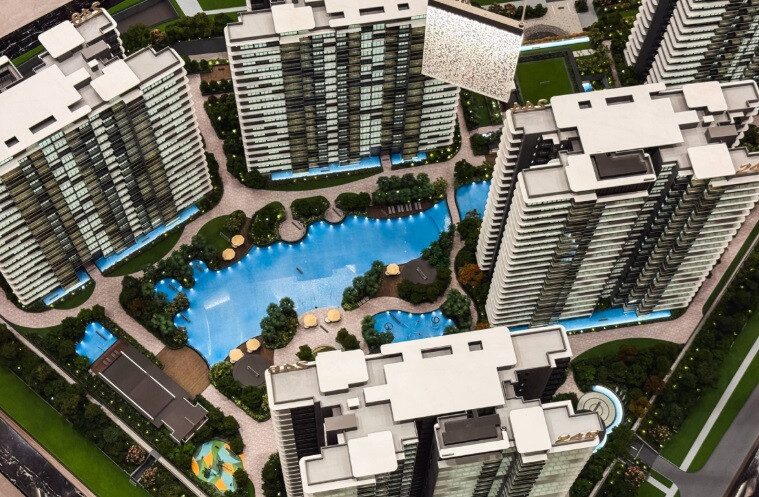

The recent surge in large-scale developments, such as AMO Residence and Chuan Park, may have skewed overall market perceptions. Many of these projects catered to pent-up demand from HDB upgraders in their respective areas.

Increased projects near MRT stations and large-scale developments:

Large-scale developments like Katong Emerald and Chuan Park offer competitive pricing, lower maintenance fees, and a wider range of amenities, even if they lack exclusivity.

The success of previous large-scale projects such as Treasure at Tampines, Normanton Park, and Parc Clematis has bolstered confidence in similar developments.

The proximity of many projects to MRT stations has significantly improved accessibility. For instance, Grand Dunman and Katong Emerald have benefited from the new Thomson-East Coast Line.

This trend is expected to have a positive impact on the stagnant redevelopment market.

Optimism driven by low-interest rates:

The recent interest rate cuts by the Federal Reserve have led to a decline in SORA-based home loan rates. This has made homeownership more affordable.

However, the possibility of the Fed pausing further rate cuts and potential inflationary pressures due to the US elections may limit future interest rate declines.

Inflow of funds from other investments:

Investors realizing gains from other markets like stocks and cryptocurrencies are shifting their funds into real estate, seen as a more stable investment and a hedge against inflation.

Attractive pricing:

Some new launches, such as Katong Emerald, have offered competitive pricing compared to earlier projects like Tembusu Grand, Grand Dunman, and The Continuum.

However, opinions on land prices and supply remain divided. Recent GLS land auctions have seen lower bids and failures, indicating the government's efforts to increase supply and curb price increases.

In conclusion, the recent boom in Singapore's property market is a result of various interconnected factors. While pent-up demand, large-scale developments, low-interest rates, and attractive pricing have played significant roles, the sustainability of this trend will depend on factors such as government policies, economic conditions, and global interest rate movements.

[Copyright (c) Global Economic Times. All Rights Reserved.]