Honolulu, Hawaii – In a bold move signaling a growing urgency to address the escalating impacts of climate change, the state of Hawaii has become the first in the United States to institute a dedicated 'climate tax.' Governor Josh Green voiced his strong endorsement on May 2nd (local time) for a bill passed by the Hawaii State Legislature that will increase the state's accommodation tax by 0.75%. This pioneering legislation aims to generate crucial funding for climate disaster preparedness and the preservation of the state's fragile environment, marking a significant step towards a more sustainable future for the islands.

The newly approved measure will raise the tax on hotel rooms, short-term vacation rentals, and timeshares. Additionally, for the first time, cruise ship passengers will be subject to an 11% tax on their fares. This increase will be layered upon Hawaii's existing 10.25% transient accommodations tax. Once Governor Green signs the bill into law, effective January 1, 2026, the state's accommodation tax will climb to 11%. When combined with the individual counties' 3% transient accommodations tax and the state's 7.712% general excise tax, tourists visiting Hawaii could face a total tax burden of up to 18.712% on their lodging and related expenses.

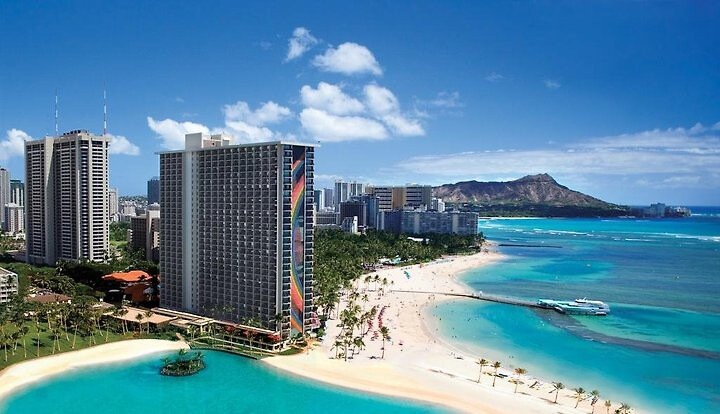

The Hawaii State Legislature projects that this modest 0.75% increase will generate an estimated $100 million in additional annual revenue. These funds are earmarked for critical environmental and climate resilience projects. A significant portion of the revenue will be directed towards replenishing the iconic Waikiki Beach, which has suffered considerable erosion due to rising sea levels and increased wave action – direct consequences of climate change. Furthermore, the funds will support initiatives to assist homeowners in installing roof reinforcement measures to better withstand increasingly intense hurricanes, a growing threat in the Pacific. The legislation also specifically addresses the need to mitigate wildfire risks by funding the removal of highly flammable non-native vegetation, identified as a contributing factor to the devastating Maui wildfires of 2023.

Governor Green hailed the bill as a landmark achievement, stating, "This bill I will sign is the first of its kind in the United States and symbolizes an intergenerational commitment to protecting our 'aina (land, earth, that which feeds us).' Hawaii is setting a new standard for responding to the climate crisis." His remarks underscore the state's commitment to proactive measures in the face of mounting environmental challenges. He has until July 9th to officially sign the bill into law.

Hawaii's initiative places it at the forefront of a growing global trend. Several popular international tourist destinations have already implemented similar 'climate taxes' or destination fees. The Maldives, a nation particularly vulnerable to sea-level rise, levies an environmental impact fee on tourists. Italy has various city taxes that, while not solely focused on climate, contribute to the upkeep of infrastructure and cultural heritage often threatened by environmental changes. Indonesia's popular island of Bali introduced a tourism levy in 2023 specifically aimed at preserving the island's unique culture and natural environment. Greece followed suit in March of last year, implementing a 'climate resilience levy' on hotel stays and other accommodations, with the funds intended to bolster the country's defenses against extreme weather events.

The rationale behind these taxes is rooted in the understanding that tourism, while economically beneficial, can also exert significant pressure on local environments and contribute to carbon emissions. By implementing a dedicated fee, destinations can generate revenue streams specifically designed to mitigate these negative impacts, invest in conservation efforts, and build resilience against climate-related disasters.

Hawaii's vulnerability to the impacts of climate change is particularly acute. The islands face a multitude of threats, including rising sea levels that erode coastlines and inundate low-lying areas, more frequent and intense hurricanes and tropical storms, increased ocean temperatures that damage coral reefs and disrupt marine ecosystems, and altered rainfall patterns leading to both droughts and floods. The devastating wildfires on Maui in 2023 served as a stark reminder of the potential for climate-related disasters to inflict immense human and economic costs.

The newly enacted accommodation tax increase represents a recognition of the interconnectedness between tourism and the environment in Hawaii. By asking visitors to contribute a small additional amount, the state aims to ensure the long-term sustainability of its tourism industry by safeguarding the very natural beauty and resources that attract visitors in the first place.

Governor Green emphasized the broader benefits of the legislation, stating, "This tax will help provide a safer Hawaii for our children, residents, and visitors." This highlights the dual purpose of the 'climate tax': not only to protect the environment but also to enhance the safety and well-being of the local population.

The implementation of this 'climate tax' is likely to spark debate, both within Hawaii and across the United States. While proponents argue for its necessity in addressing the urgent threats of climate change and funding crucial environmental protection measures, concerns may arise regarding the potential impact on tourism, a vital sector of Hawaii's economy. However, the relatively modest 0.75% increase suggests an attempt to balance the need for revenue with the desire to remain a competitive tourist destination.

Ultimately, Hawaii's pioneering 'climate tax' represents a significant step forward in acknowledging the financial responsibilities associated with climate change adaptation and mitigation. As the first state in the US to implement such a measure, Hawaii is setting a precedent that other states and regions facing similar environmental challenges may consider following. The success of this initiative will likely be closely watched as the world grapples with the increasing urgency of addressing the climate crisis and its far-reaching consequences. The funds generated by this tax hold the promise of bolstering Hawaii's resilience and ensuring the preservation of its unique natural heritage for generations to come.

[Copyright (c) Global Economic Times. All Rights Reserved.]