Seoul, South Korea - Global financial markets experienced a sharp sell-off following a significant escalation in the U.S.-China trade war over the weekend, yet South Korea’s benchmark KOSPI index, which recently hit a new record high, may stand to gain from the turmoil. The renewed trade hostilities have triggered a widespread retreat from U.S. dollar-denominated assets, a phenomenon some analysts believe could redirect capital flows towards undervalued emerging markets like South Korea.

The intensification of the trade war saw U.S. markets plummet on October 10. The Dow Jones Industrial Average dropped 1.90%, the S&P 500 slid 2.71%, and the tech-heavy NASDAQ suffered the largest decline, falling 3.56%. This market shock was the biggest single-day loss since April, when President Donald Trump first declared his 'Day of Liberation' and announced a global tariff increase.

The immediate trigger was a tit-for-tat exchange of trade restrictions. After China moved to restrict exports of rare earth minerals, President Trump retaliated by threatening an additional 100% tariff on Chinese goods and announcing a ban on exports of "critical software" to the country. The resulting panic also hit cryptocurrencies, with Bitcoin falling 10% and Ether dropping 15%, while international oil prices, specifically WTI futures, declined over 4% on fears of a global economic slowdown.

Tech Sector Hit Hard, But Opportunity Looms for Korea

The technology sector bore the brunt of the sell-off, with the Semiconductor Index plunging 6.32%. Chip giants like Nvidia and its competitor AMD fell nearly 5% and 8% respectively, a development that is expected to exert downward pressure on South Korea's own semiconductor heavyweights, Samsung Electronics and SK Hynix.

However, the silver lining for the KOSPI lies in the simultaneous drop of the U.S. dollar. The Dollar Index fell 0.55% to 98.73 points, signaling a significant liquidation of U.S. dollar assets. This "de-dollarization" trend, driven by geopolitical uncertainty and an attempt by global investors to diversify away from the U.S. financial system, could prove beneficial for emerging markets.

"If the sell-off in dollar assets accelerates, the capital that has been sidelined could flow into emerging markets, giving a reflective boost to the Korean stock market," stated a Seoul-based market analyst.

KOSPI's Record Run and the Chip Factor

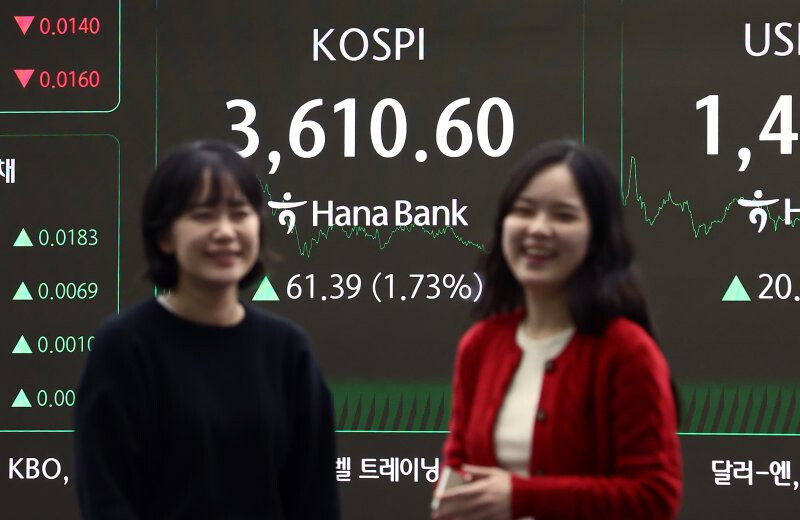

The KOSPI has already demonstrated remarkable strength, recently closing at a historic high of 3,610.60 on October 10, fueled by both a sustained global chip rally and "pro-market" policies implemented since the Lee Jae-myung administration took office. Foreign investors have been net buyers, contributing to the index's record-breaking climb.

Crucially, South Korean chip stocks are considered relatively undervalued compared to their American counterparts. Samsung Electronics, in particular, had lagged in the global rally due to a delay in the approval of its High Bandwidth Memory (HBM) chips by Nvidia. The recent news of Nvidia's eventual approval, however, has ignited a fresh rally, suggesting significant room for further growth.

Analysts concur that the combination of continued pro-market economic policies and an enduring semiconductor upcycle, coupled with the potential for long-term capital rotation out of dollar assets, makes the KOSPI a compelling investment destination despite the immediate global trade headwinds. The escalation of the U.S.-China trade conflict, while a source of short-term volatility, may ultimately serve as an accelerator for capital diversification into markets offering both political stability and high-growth technology exposure.

[Copyright (c) Global Economic Times. All Rights Reserved.]